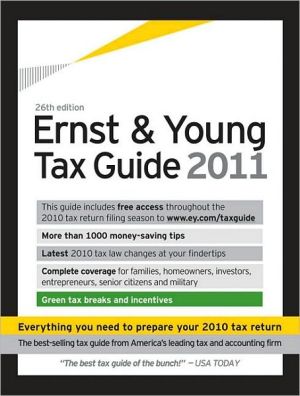

Ernst & Young Tax Guide 2011: Preparing Your 2010 Taxes

The Ernst & Young guide addresses everything from overlooked credits to medical and dental expenses in a clear, easy-to-understand way. Its all-new 2-color design, the first redesign in several years, ensures ease of use and ready access to essential information, while its user-friendly, line-by-line instructions and explanations and inside look at what the IRS doesn’t tell you make it the most comprehensive and well-rounded tax guide on the market. Updates on tax law changes since the...

Search in google:

The Ernst & Young guide addresses everything from overlooked credits to medical and dental expenses in a clear, easy-to-understand way. Its all-new 2-color design, the first redesign in several years, ensures ease of use and ready access to essential information, while its user-friendly, line-by-line instructions and explanations and inside look at what the IRS doesn’t tell you make it the most comprehensive and well-rounded tax guide on the market.

The Latest 2009 Tax Law Changes Tips To Slash Your Taxes This Year and Next Reminders That Keep Track of Important Tax Records How to Avoid Some of the Most Common Filing Errors New Tax Laws and Regulations and How They Affect You Continuously Updated Web Site! OVER 1,000 MONEY SAVING TIPS 50 Overlooked Deductions How to Avoid 25 Common Errors Chapter 1-Filing Information Chapter 2-Filing Status Chapter 3-Personal Exemptions & Dependents Chapter 4-Tax Withholding and Estimated Tax Chapter 5-Wages, Salaries and Other Earnings Chapter 6-Tip Income Chapter 7-Interest Income Chapter 8-Dividends and Other Corporate Distributions Chapter 9-Rental Income and Expenses Chapter 10-Retirement Plans, Pensions, and Annuities Chapter 11-Social Security and Equivalent Railroad Retirement Benefits Chapter 12-Other Income Chapter 13-Basis of Property Chapter 14-Sale of Property Chapter 15-Selling Your Home Chapter 16-Reporting Gains and Losses Chapter 17-Individual Retirement Accounts (IRAs) Chapter 18-Alimony Chapter 19-Education-Related Adjustments Chapter 20-Moving Expenses Chapter 21-Standard Deduction Chapter 22-Medical and Dental Expenses Chapter 23-Taxes You May Deducts Chapter 24-Interest Expense Chapter 25-Contributions Chapter 26-Casualty and Theft Losses Chapter 27-Car Expenses and Employee Business Expenses Chapter 28-Tax Benefits for Work-Related Education Chapter 29-Miscellaneous Deductions Chapter 30-Limit on Itemized Deductions Chapter 31-How to Figure Your Tax Chapter 32-Tax on Investment Income of Certain Children Chapter 33-Child and Dependent Care Credit Chapter 34-Credit for the Elderly or the Disabled Chapter 35-Child Tax Credit Chapter 36-Education Credits and Other Education Tax Benefits Chapter 37-Other Credits Including the Earned Income Credit Chapter 38-Self-Employment Income:How to File Schedule C Chapter 39-Mutual Funds Chapter 40-What to Do If You Employ Domestic Help Chapter 41-U.S. Citizens Working Abroad: Tax Treatment of Foreign Earned Income Plus 10 more chapters, and 100s of charts, tables & forms!