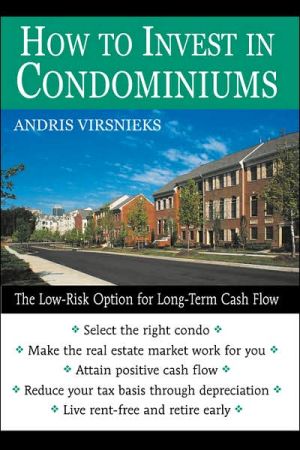

How to Invest in Condominiums: The Low-Risk Option for Long-Term Cash Flow

A simple proven method for improving cash flow so you can live rent-free and retire early\ How to Invest in Condominiums provides a simple, low-risk blueprint for building cash flow by buying and renting out condominiums. You can provide for your retirement or improve your monthly income by investing in income-producing real estate at a very low risk to the capital you invest. Unlike stocks and bonds, real estate is immune to inflation and a fluctuating stock market and also provides some...

Search in google:

A simple proven method for improving cash flow so you can live rent-free and retire earlyHow to Invest in Condominiums provides a simple, low-risk blueprint for building cash flow by buying and renting out condominiums. You can provide for your retirement or improve your monthly income by investing in income-producing real estate at a very low risk to the capital you invest. Unlike stocks and bonds, real estate is immune to inflation and a fluctuating stock market and also provides some shelter from taxes–and the return on investment typically exceeds that of the average Wall Street investor! The author includes a plan for getting started and a detailed record of his investments that shows how he grew a considerable cash flow–with only a small commitment of time and effort. This straightforward, realistic guide will help you:Use this method to establish long-term cash flowAvoid owning a money-losing rental unitUse professional property management to save time and moneyAvoid "fixer-uppers" v Keep your long-run effort minimalLive rent-free and retire early!How to Invest in Condominiums is a reliable and realistic way to supplement your income. There are no gimmicks and no strings attached and this is not a get-rich-quick scheme. It’s a long-term plan that will help you meet–and surpass–your long-term goals.

PrefaceIntroductionCh. 1Not a Bear or a Bull, but Always a Cash Cow1Ch. 2Seven Easy Condominiums11Ch. 3Principles for Selecting the Right Condominiums33Ch. 4Why Condominium Investments Succeed65Ch. 5Why Condominiums and Not Apartments or Houses?79Ch. 6Condominiums versus Stocks and Bonds103Ch. 7What Next and How Far Can You Go?137Ch. 8An Act of Faith Is Still Required151Epilogue157App. ANegative Cash Flow but Still Making Money159App. BPositive Cash Flow - Rent 10% Higher Than in Appendix A161App. CNo Leverage - Same As Appendix A Except No Mortgage Payment163App. DWorst-Case Scenario without Leverage - Same as Appendix C Except No Rent165App. EFifty Percent Increase in Rent - with Leverage167App. FFifty Percent Increase in Rent - Same as Appendix E but without Leverage169App. GWorst-Case Scenario with Leverage - Same as Appendix A Except No Rent171App. HKing County Home Sales, Seattle Post-Intelligencer, February 28, 1997173App. IRate of Return on Investment from Rent (Net Income) and Price Appreciation175App. JRate of Return Calculation for Condominium Number 2177App. KRate of Return Calculation for Condominium Number 5179App. LMore Recent News about Condominiums and Real Estate181Glossary187Endnotes193Index199