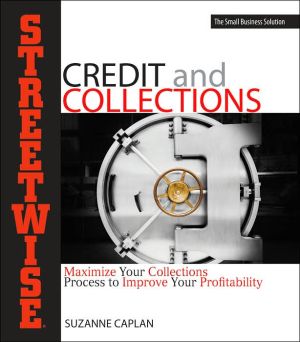

Streetwise Credit And Collections: Maximize Your Collections Process to Improve Your Profitability

The credit and collection function of any business is the nerve center of the Company. If proper records aren't kept and receivables closely monitored, a Company will have difficulty maintaining its cash flow and Operations. Streetwise[Registered] Credit and Collections provides you with the skills to manage your company's financial obligations, collect due payments, and avoid falling into debt.\ Streetwise[Registered] Credit and Collections includes complete state-by-state requirements for...

Search in google:

The credit and collection function of any business is the nerve center of the company. If proper records aren't kept and receivables closely monitored, a company will have difficulty maintaining its cash flow and operations. Streetwise Credit and Collections provides you with the skills to manage your company's financial obligations, collect due payments, and avoid falling into debt. Streetwise Credit and Collections includes complete state-by-state requirements for small claims court, and sections on the applicable laws, statute of limitations, and legal interest rates that may be charged. The appendices contain information necessary for all businesses that grant credit, including the Equal Credit Opportunity Act and the Fair Debt Collection Practices act.Includes advice on:Securing credit and granting itSetting credit policies for your customersHiring a collections agency as necessaryYou will undoubtedly encounter credit and collection issues from time to time. With Streetwise Credit and Collections, you'll have the information and advice to make the best business decisions and keep your cash flow healthy.

Acknowledgments ixIntroduction xiWhy Credit Is a Business Necessity 1How Credit Creates Leverage 1The Leverage to Start a Business 2Cash Is a Timing Issue 3Turning Assets into Collateral 4Your Bank as a Source of Credit 5Securing Loans for Working Capital 6Selling an Account to a Factor 8Floor Planning Inventory 9Securing Credit from Vendors 11Establish Credibility 12Negotiating Terms 13Working with Consignment 14The Importance of a Track Record 16What to Do When Cash Is Tight 17Securing Discounts for Prompt Payment 17Providing Credit to Business Customers 19The Difference Between Consumer Credit and Business Credit 20Using Credit as an Incentive 22Who Carries the Paper? 22A Business Credit Application 23Reading a Business Credit Report 25Types of Credit: Short-Term and Long-Term 26Asking for a Deposit 28Make Sure Your Policy Is Evenhanded 29Credit Takes You Global 31Opportunities Through Foreign Trade 32Buying from a Foreign Firm 33Letters of Credit: Providing Assurance 34Standby Letters of Credit 36How Banks Protect Their Interest 37What Bank Should You Use? 38Providing Material to Be Fabricated in a Foreign Country and Shipped to You 38Your Business Sells Your Goods or Services in Foreign Markets 39The Export-Import Bank and Your Business 40Obtaining Credit Information on Foreign Firms 41Providing Credit to Consumers 45Understanding Consumer Credit Laws 46Applications for Consumer Credit 47Checking Credit Reports 48The Equal Credit Opportunity Act 50Can You Use Third-Party Financing? 53Collecting Through Professional Firms 54An Effective Credit Policy 56The Elements of Your Plan 57How Much Credit Can You Provide? 58Who Will Handle Credit Checks and Decisions? 59An Override Policy 61Personal Guarantees 62Periodic Recheck and Review 62When to Raise and When to Lower Limits 65Assessing Risk 67Can You Cover Your Costs? 68The Difference Between Secured and Unsecured Credit 69The Value of a Personal Guarantee 70Securing a Confession of Judgment 70Evaluating Trade Credit References 72Checking a Bank Reference 73Out-of-State Credit 73Asking for Financials 74Setting a Proactive Credit Limit 77Allowing Customers to Buy According to Their Need 78Special Deals Require Special Terms 80Secondary Protection: Using Outside Credit Resources 81Growing Customers Need Growing Credit 82Reducing a Limit or Requiring Cash 83Communicating Your Policies 87Put Your Policy in Writing 88Letters Granting Credit and Stating Terms 92Print Your Terms on Invoices and Statements 94Post Credit Terms and Return Policies in Your Place of Business 94Can You Charge Interest on Past-Due Accounts? 97Creating the Paper Trail 99Purchase Orders and Contracts Must Be in Writing 100A Sample Purchase Order and Confirmation 102Keep Track of Invoices, Payments, and Credits 104Change Orders Must Be in Writing 107Contact Reports on All Billing Inquiries 108Record All Statements and Letters 108Putting Policy into Practice 110The Collection Begins with the Safe 111Make Sure the Billing Is Accurate 112Learn What Constitutes an Acceptance 112Proof of Delivery 114Make Sure Your Customer Is Satisfied 115Handle Disputes in Writing and Issue Credit 117How Much of a Discount Can You Afford? 118Letters to Confirm the Outstanding Amount Due 119Dealing with Third-Party Funders 121Keep Your Source Documents after the Charge 122With Contract Financing, Proper Documents Must Be Submitted 124What Happens If Your Client Does Not Pay? 125Credit Card Disputes Can Result in Charge-Backs 127Form Alliances with Funders to Access Credit 128The Fine Art of Reminders 131Send Regular Statements 132The First Friendly Request 134Making a Demand for Payment 134Making Contact via Phone 136Having a Salesperson Help to Collect 138Six Sample Letters 138Handling a Dispute 143Take the Time to Research 144Establish Your Side of the Story 146Compromise When It Makes Sense 147Get the Agreement of the New Terms in Writing 148Some Disputes Are Ploys to Not Pay 149Dealing with a Bounced Check 150The First Steps in the Collection Procedure 153Call the Customer Yourself 154Ask for a Payment Schedule 155Send Out Demand Letters via Registered Mail 156One Final Request Before the Account Is Turned Over 157A Postdated Check Is Only a Promise to Pay 159Aggressive Collections 160Collecting from a Consumer 161Understanding FDCPA 162The Collection Call 162Do Not Violate the Applicable Law 164What to Do When You Are Told to Cease 165Staying Polite and Providing Customer Service While Collecting 166Making a Decision to Turn Over an Account 166Collecting from a Business 171FDCPA Does Not Apply 172Calls Are Now Serious Business 173Document All of Your Demands 174Personal Visits Are Allowed and Might Work 175Can You Take It to Small Claims Court? 176A State-by-State Review of Small Claims Court 177Collecting from a Tenant 189The Terms Are in the Lease 190Residential Leases 191Commercial Leases 192Handling a Dispute 193Giving Notice to a Past-Due Tenant 194Negotiating a Settlement 195Handling an Eviction 196When to Hire an Agency 199Check Out Agencies Before You Need One 200Try One That Reports Credit as Well 203What Do Agencies Generally Charge? 204Do Not Hire an Agency That Poses as a Law Firm 204What Can an Agency Actually Do? 205When Is It Time to Turn Over the Account? 206When to Hire a Lawyer 209Get Something Filed Before It's Too Late 210An Ounce of Prevention 211Judgments and Liens 212When You Have a Confession of Judgment 214Judgments Are Not Money-They Must Be Collected 215Your Rights When a Debtor Fails 219Are You Secured in Any Assets? 220Three Types of Bankruptcy 220A Recent Purchase May Be Reclaimed 221Chapter 7-Get Your Portion of the Distribution 222Chapter 13-As a Creditor, Get Monthly Payments 223Chapter 11-Be a Member of the Committee When Possible 224Should You Do Business Again with the Same Customer? 226The Art of Credit 228The Psychology of Money 229Why Some Creditors Never Make Demands 230Customers Who Don't Pay Even When They Are Able 232Tips on Having Discussions about Money 234Know Whom You Are Dealing with First 235Discounting to Make a Friend 235When You Are the Debtor 237Always Communicate with Your Creditors 238Do Not Promise What You Cannot Pay 239Make an Honest Offer and Stick to It 240Don't Be Frightened by Threats 241How to Deal with Taxing Authorities 242When Money Is Tight, Prioritize 243Creative Credit Techniques 247Using a Factor 248Securing Deposits and Retainers Before You Work 250Floor Planning and Installment Loans 251Debit Cards, Credit Cards, and Electronic Funds Transfer 251COD: Cash on Delivery 253Progress Payments 254Credit Insurance to Rely On 254Operating a Financially Sound Company 257Profit Isn't Real until the Money Is Received 258Bad Debts Can Undermine a Good Business 260Your Credit Provides You with Options 261Credit and Trust Are Twin Values-Use Both 262If You Have Done the Work, You Are Entitled to the Money 263Epilogue 265AppendixesGlossary 267Applicable Laws and Statutes of Limitations by State 273Consumer Credit Laws to Know 297Index 329