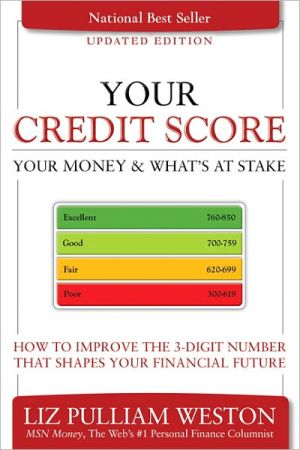

Your Credit Score: Your Money and What's at Stake: How to Improve the 3-Digit Number That Shapes Your Financial Future

“A great credit score can help you finish rich! Liz Pulliam Weston gives solid, easy-to-understand advice about how to improve your credit fast. Read this book and prosper.”\ David Bach, bestselling author of The Automatic Millionaire and The Automatic Millionaire Homeowner\ “Excellent book! Insightful, well written, and surprisingly interesting. Liz Pulliam Weston has done an outstanding job demystifying an often intimidating and frustrating topic for the benefit of all consumers.”\ Eric...

Search in google:

“A great credit score can help you finish rich! Liz Pulliam Weston gives solid, easy-to-understand advice about how to improve your credit fast. Read this book and prosper.”David Bach, bestselling author of The Automatic Millionaire and The Automatic Millionaire Homeowner“Excellent book! Insightful, well written, and surprisingly interesting. Liz Pulliam Weston has done an outstanding job demystifying an often intimidating and frustrating topic for the benefit of all consumers.”Eric Tyson, syndicated columnist and bestselling author of Personal Finance for Dummies“No one makes complex financial information easy to understand like Liz Pulliam Weston. Her straight-talk and wise advice are invaluable to anyone with a credit card or check book–and that’s just about all of us.”Lois P. Frankel, Ph.D., author of Nice Girls Don’t Get the Corner Office and Nice Girls Don’t Get Rich“In a country where consumers increasingly pay more when they have bad credit, Liz Pulliam Weston’s book provides excellent tips and advice on ways to improve your credit history and raise your credit score. If you just apply one or two of her insightful suggestions, you’ll save many times the cost of this book.”Ilyce R. Glink, financial reporter, talk show host, and bestselling author of 100 Questions Every First-Time Home Buyer Should Ask“Your credit score can save you money or cost you money–sometimes a lot of money. Yet, most people don’t even know their scores, much less know how to make them better. Liz Pulliam Weston can help you fix that. In this easy-to-understand guide you’ll learn how to make sure your score helps you get the best deal on loans and insurance. You can’t afford not to read it.”Gerri Detweiler, consumer advocate and founder of UltimateCredit.comThe #1 Best-Selling Guide to Improving Your Credit Score...Now Thoroughly Updated for the Financial Crisis!In post-crash America, it’s tough to get credit...and even tougher to get rates and terms you can afford. That makes your credit score more important than ever before. Now, MSN Money/L.A. Times personal finance columnist Liz Pulliam Weston has updated her best-selling book on credit scores to show how you can maximize your score right now–and save yourself a fortune!Weston reveals the tough new realities of borrowing and credit scoring, and shows why they aren’t going to change any time soon. She rips away the mystery surrounding credit scoring, including the FICO 08 overhaul, and tells you exactly how to use the new system to maximize your score.You’ll learn how to fight back against lenders who want to lower your limits or raise your rates...bounce back from bad credit and bankruptcy...choose the right credit solutions and avoid options that only make things worse. One step at a time, Weston will help you build (or rebuild) your credit score–so you can get the credit you need and deserve!Survive a credit crisis, one step at a timeHow to protect or rebuild your credit score after a major financial setbackFix your credit score in as little as 72 hoursRapid rescoring: what it can fix, what it can’t fix, and how to use itDon’t let the myths of credit scoring cost you a fortune!What you’ve been told just isn’t true: how credit scores really workWhat drives your score–and what doesn’tThe real impact of credit cards, loans, late payments, inquiries, credit counseling, and more

Your Credit Score Your Credit Score, Your Money & What’s at Stake: How to Improve the 3-Digit Number That Shapes Your Financial Future Introduction to the Updated Edition\ “In recent years, a simple three-digit number has become critical to your financial life.”\ That is the sentence that opens Chapter 1 of this book. In previous editions, the statement was a surprise to many readers.\ Although most people had heard of credit scores, I’d found relatively few really understood the pervasive impact these numbers have in our financial systems and our day-to-day lives.\ Now, their impact is obvious, thanks to the financial crisis that began in 2008.\ In the years leading up to the implosion, lenders that had once used credit scores as a factor in their decisions started to rely on them almost exclusively, ignoring other important details such as the borrower’s income, assets, job stability, and other debts.\ Lenders made riskier and riskier loans thanks to their over-reliance on credit-scoring formulas. Wall Street encouraged the gambles by snapping up massive bundles of this toxic debt and selling them to investors. Financial firms compounded their exposure with complicated financial instruments, including derivatives and credit default swaps.\ As mortgage defaults rose, the effects boomeranged through the financial industry. Suspicion spread that banks and Wall Street firms were hiding the true impact of bad loans on their bottom line, causing investors to bail and once-chummy firms to stop lending to one another.\ The credit crisis quickly became a conflagration that spread throughout the global economy, destroying Wall Street behemoths and leading to unprecedented government interventions and bailouts.\ Yet this calamity didn’t undermine the importance of credit scores for consumers. They’re more crucial than ever.\ As the crisis grew, the world split into two, with one set of rules for the credit “haves” and another for the “have nots.”\ People who didn’t have good credit scores saw their options dwindle as the lenders that once courted their business were forced into bankruptcy. The banks and credit card issuers that remained grew wary of taking any risk, particularly with borrowers who had trouble paying their bills in the past.\ By mid-2008, for example, auto lenders were approving fewer than one in four applications from would-be car buyers with bad credit. A year earlier, those lenders had approved two out of three borrowers with the same poor scores.\ Rejection rates soared for mortgages and other loans, as well. Credit card issuers began raising rates and lowering limits first on their highest-risk customers, then on those with better credit.\ But people who had the highest scores still had plenty of options.\ Lenders need to make loans to make money, so they concentrated their efforts on the people most likely to pay them back. Credit card issuers, in particular, continued to pelt these desirable consumers with low-rate offers. Savvy borrowers quickly discovered that if their current issuer wouldn’t rescind a rate increase or restore a credit limit, they could just go to a competitor.\ Other kinds of lenders eagerly catered to this low-risk crowd, as well. Folks with high scores could still secure low-rate car loans, private students loans, and mortgages (even though home loans generally required higher down payments than in the recent past).\ Lending standards may loosen as time passes, but they’re unlikely to return soon to the anything-goes excesses that triggered the financial crash. So while credit scores won’t be the only factor in lenders’ decision making, they’ll retain a major role in who gets credit and how much it costs.\ So—now more than ever—knowing how to fix, improve, and protect your credit score are essential skills for successfully navigating your financial life.\ Praise Quotes\ “A great credit score can help you finish rich! Liz Pulliam Weston gives solid, easy-to-understand advice about how to improve your credit fast. Read this book and prosper.”\ —David Bach, bestselling author of The Automatic Millionaire and The Automatic Millionaire Homeowner\ “Excellent book! Insightful, well written, and surprisingly interesting. Liz Pulliam Weston has done an outstanding job demystifying an often intimidating and frustrating topic for the benefit of all consumers.”\ —Eric Tyson, syndicated columnist and bestselling author of Personal Finance for Dummies\ “No one makes complex financial information easy to understand like Liz Pulliam Weston. Her straight-talk and wise advice are invaluable to anyone with a credit card or check book— and that’s just about all of us.”\ —Lois P. Frankel, Ph.D., author of Nice Girls Don’t Get the Corner Office and Nice Girls Don’t Get Rich\ “In a country where consumers increasingly pay more when they have bad credit, Liz Pulliam Weston’s book provides excellent tips and advice on ways to improve your credit history and raise your credit score. If you just apply one or two of her insightful suggestions, you’ll save many times the cost of this book.”\ —Ilyce R. Glink, financial reporter, talk show host, and bestselling author of 100 Questions Every First-Time Home Buyer Should Ask\ “Your credit score can save you money or cost you money—sometimes a lot of money. Yet, most people don’t even know their scores, much less know how to make them better. Liz Pulliam Weston can help you fix that. In this easy-to-understand guide you’ll learn how to make sure your score helps you get the best deal on loans and insurance. You can’t afford not to read it.”\ —Gerri Detweiler, consumer advocate and founder of UltimateCredit.com\ © Copyright Pearson Education. All rights reserved.

Acknowledgments xviiAbout the Author xixIntroduction to the Third Edition xxiChapter 1 Why Your Credit Score Matters 1Chapter 2 How Credit Scoring Works 15Chapter 3 VantageScore–A Revolution or Just More of the Same? 37Chapter 4 Improving Your Score–The Right Way 45Chapter 5 Credit Scoring Myths 65Chapter 6 Coping with a Credit Crisis 77Chapter 7 Rebuilding Your Score After a Credit Disaster 101Chapter 8 Identity Theft and Your Credit 123Chapter 9 Emergency! Fixing Your Credit Score Fast 145Chapter 10 Insurance and Your Credit Score 155Chapter 11 Keeping Your Score Healthy 171Index 187